Startups and venture capital industry jargon can often be a major hurdle for founders, especially those new to the ecosystem. While terms like “seed funding,” “unicorns,” and “venture rounds” are commonly seen in headlines, they represent only a fraction of the complex vocabulary that founders must grasp to thrive. Without a solid understanding of the full range of VC terminology, it becomes difficult to navigate funding discussions, structure deals, and set clear growth expectations.

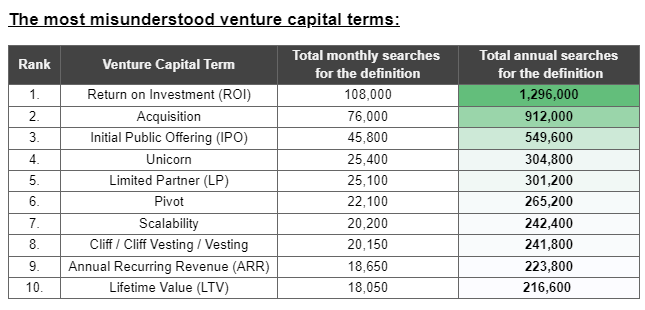

Recognizing this, Oxford Capital has conducted an in-depth analysis of the most misunderstood venture capital terms. Mark Bower-Easton, the firm’s Head of Distribution, lends expert commentary to shed light on these essential terms. Whether you’re a new founder or looking to sharpen your knowledge, understanding these financial nuances is critical to making sound strategic decisions.

Return on Investment (ROI): The Most Misunderstood VC Term

Among all venture capital terms, “Return on Investment” (ROI) leads as the most misunderstood and most searched term, with over 108,000 monthly searches globally, translating to more than 1.2 million annual queries. Grasping ROI is fundamental for founders because it serves as a key metric for assessing the financial performance of a startup.

Mark Bower-Easton explains:

“ROI measures the efficiency and profitability of an investment by comparing the gain or loss relative to its cost. For venture capital, understanding ROI is crucial as it helps founders and investors assess whether the returns justify the investment risk. Many founders find ROI challenging because it’s not just about immediate financial returns but also about long-term strategic value and growth potential.”

For founders, a deep understanding of ROI enables better resource allocation and more informed decisions regarding future funding rounds. Investors, on the other hand, rely on ROI to determine if a startup is worth their time and money. Misinterpreting or overlooking ROI can lead to poor financial planning, unrealistic goals, and weakened investor confidence.

Acquisition: A Key Strategy for Growth

The term “Acquisition” follows closely behind ROI in terms of search frequency, with 76,000 global searches per month, or over 900,000 annually. Acquisitions play a pivotal role in the strategic decisions of both startups and established companies, yet the complexities of acquisition deals are often misunderstood.

Bower-Easton elaborates:

“An acquisition involves a company purchasing another to achieve strategic goals such as market expansion, acquiring new technology, or entering new sectors. For founders, understanding acquisitions is vital because it influences their startup’s valuation and can serve as an exit strategy.”

For many startups, an acquisition represents a successful outcome. Founders who understand the ins and outs of this process can better position their company for acquisition and negotiate more favorable terms. Without this knowledge, they risk missing out on opportunities, undervaluing their company, or signing unfavorable deals.

Initial Public Offering (IPO): A High-Stakes Decision

The term “Initial Public Offering” (IPO) garners significant interest, with over 45,000 monthly searches globally, indicating the importance of this high-stakes decision for many startups. An IPO is the moment when a private company offers shares to the public for the first time, making it one of the most critical junctures in a startup’s life cycle.

Bower-Easton points out:

“An IPO, or Initial Public Offering, is when a company offers its shares to the public for the first time to raise capital. This process can significantly impact a startup’s trajectory, opening doors for more funding opportunities and enhancing the company’s resources and public profile.”

While an IPO offers significant opportunities for growth and capital influx, it also brings challenges. Founders must be aware of the regulatory demands and scrutiny that come with going public. Without proper preparation, startups can face difficulties maintaining compliance and managing investor expectations. Knowing when and how to pursue an IPO can be the difference between accelerating a company’s growth and overextending its resources.

Unicorn: Rare, But Not Always a Success

Ranking fourth in search volume is the term “Unicorn,” which sees 25,400 monthly searches globally. A unicorn refers to a privately held startup valued at over $1 billion, a status often celebrated in the venture capital world. However, becoming a unicorn doesn’t guarantee long-term success.

Bower-Easton adds:

“A unicorn is a privately held startup valued at over $1 billion that has achieved significant market validation. With just over 300 unicorns globally, mainly concentrated in the U.S. and China, this status signifies major market achievements. But reaching unicorn status doesn’t guarantee profitability or sustainability.”

While the unicorn label can attract media attention and investor interest, it also brings challenges. Founders must manage the high expectations that come with the title, balancing rapid growth with sustainable practices. Without careful planning, the pressures of maintaining unicorn status can lead to financial instability or burnout.

Why Understanding Venture Capital Terms Is Crucial for Founders

For startup founders, especially those new to the venture capital landscape, a clear understanding of key terms like ROI, acquisitions, IPOs, and unicorns is essential. These concepts shape every stage of a startup’s journey—from securing initial funding to strategizing long-term growth. Mastering this terminology enables founders to negotiate confidently with investors, align their business strategies, and make informed decisions that propel their ventures toward sustainable success.

Being well-versed in these terms helps founders navigate the complex world of venture capital, ensuring they are prepared to make decisions that will impact their company’s future. Whether it’s understanding how ROI influences investor decisions, negotiating favorable acquisition terms, preparing for an IPO, or managing the pressures of unicorn status, founders who grasp these concepts are better equipped to steer their startups toward scalable growth.

In an ever-evolving startup ecosystem, knowledge is power—and mastering the language of venture capital is the first step in ensuring that power is used to its full potential.

Methodology:

- Oxford Capital set out to identify the most misunderstood venture capital terms.

- To achieve this, they first compiled a seed list of venture capital jargon using various articles.

- They then used search analytics tool Ahrefs to analyse the number of monthly searches globally by combining each keyword with “meaning” and “definition.”

- The monthly search volumes were added together, and the total was multiplied by 12 to generate an annual report.

- Finally, the terms were ranked in ascending order to produce a top 10 list.

- The study was carried out on 28 August and all data is correct as of then.

- Please find the full data set of all terms used in this study, here.